Payments

Setup Instructions

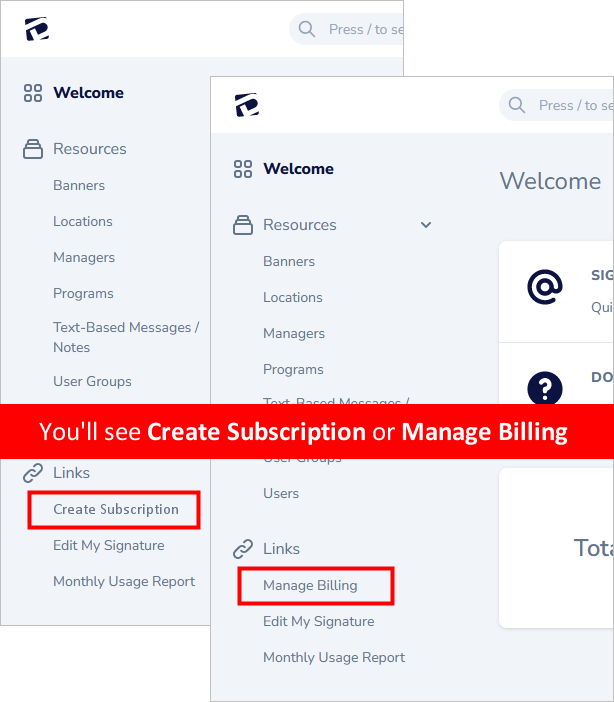

Click "Create Subscription" or "Manage Billing" in the left menu:

This will open up the billing profile page:

If you would prefer to receive monthly invoices that you can pay by credit-card, ACH transfer, or check, on your own schedule, please email us here and we will set your account up that way (instead of automatically charging the credit card you have on file). NOTE: You will still have to set up your payment profile using a valid credit card, but it will not be charged.

Processing Detail

We utilize Stripe.

Stripe is PCI-DSS compliant: Stripe is certified as a Level 1 Service Provider, which is the highest level of certification for payment processors. Stripe complies with the Payment Card Industry Data Security Standard (PCI-DSS), a set of security standards established by major card brands like Visa, Mastercard, and American Express. This compliance ensures that Stripe maintains a secure environment for handling credit card data.

Stripe uses data encryption: Stripe employs strong encryption methods to safeguard data transmission. All communication between customers, businesses, and Stripe servers is encrypted using industry-standard TLS (Transport Layer Security) encryption. This ensures that sensitive data processed by Stripe, such as credit card details, are securely transmitted over the internet.

Stripe utilizes tokenization: Stripe uses tokenization to enhance security. When a customer makes a payment, their credit card information is replaced with a unique token. This token is used by Stripe for subsequent transactions, eliminating the need to store sensitive card details on the merchant’s servers. As a result, even if a merchant’s systems are compromised, the tokenized data alone is useless to potential attackers.

Stripe employs two-factor authentication (2FA): Stripe offers the option of enabling two-factor authentication for account access. This adds a high degree of security by requiring users to provide a second form of verification, such as a unique code sent to their mobile device, in addition to their regular login credentials.

Stripe ensures fraud prevention: Stripe’s advanced machine learning algorithms detect and prevent fraudulent activities. Using these algorithms, Stripe analyzes various data points, such as transaction patterns, IP addresses, and user behavior, to identify suspicious transactions and mitigate potential risks. Additionally, Stripe provides tools and features that allow businesses to implement customized fraud prevention rules and measures.

Stripe performs security audits and monitoring: Stripe performs regular security audits and assessments to identify and address potential vulnerabilities. The company has a dedicated team of security experts who continuously monitor the platform for any suspicious activities or threats. This proactive approach helps ensure the ongoing security of the payment platform.

Stripe follows compliance and regulatory standards: To guarantee your business’ safety, Stripe adheres to various compliance requirements, including GDPR (General Data Protection Regulation) in Europe and other applicable data protection laws. By complying with these regulations, Stripe ensures the protection of personal data and privacy for its customers.